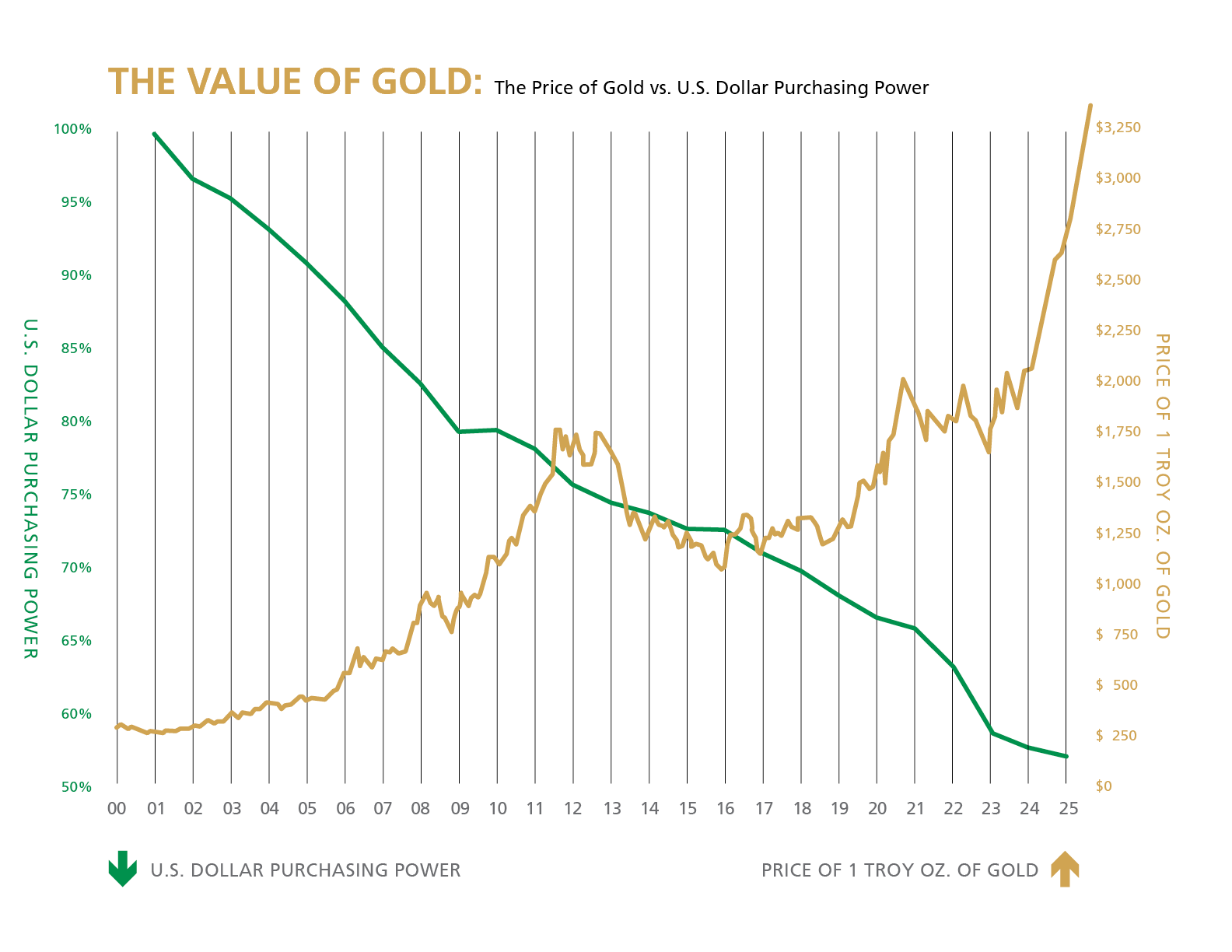

Because in times of economic volatility, gold's performance has traditionally been strong while paper currencies have fluctuated. In fact, just since 2000, the price of gold has risen by over 900%, as of July 1, 2025, while the dollar's purchasing power has declined over 40%. By buying gold and including it in your assets, you'll potentially help safeguard and strengthen your wealth against inflation, political instability and stock market fluctuations.

Rosland Capital is your gold and precious metals resource. We're based in Los Angeles, California, and our business has expanded considerably since our inception in 2008. The company is overseen by CEO Marin Aleksov, a 25-year veteran of the precious metals industry. Learn more about us by checking out our pages on Facebook, X, Linkedin, and Instagram. You can also visit our business profiles on Bloomberg and Crunchbase for additional information.

Rosland Capital is one of the leading precious metals firms in the industry. We are dedicated to earning your trust, learning about your unique goals, and serving you if you decide to include gold in your portfolio. Rosland offers its customers:

Rosland Capital offers the expertise to help you make informed and confident decisions about obtaining physical gold as part of a diverse spread of assets.

Gold, arguably the most desirable of precious metals, has universal appeal and global acceptance. As one of the oldest and most widely acknowledged forms of currency, gold's intrinsic value makes it an attractive choice to consider.

Gold has stood the test of time as a reliable source of wealth, especially in unstable periods throughout history. It was first used as money in the form of crudely stamped coins circulating around 700 B.C. Today, people buy gold coins and gold bars as a trusted method of helping potentially in protecting their wealth. Many experts believe you should guard against today's volatile economic environment by supporting your savings with gold and other precious metals:

Whether you're looking to help potentially protect your assets or collect beautiful, exclusive coins, Rosland Capital offers numerous types of gold products for consumer purchase:

Bullion bars—Bullion is the bulk form of precious metals, and gold bullion bars are regularly traded on major markets.

Bullion coins—Gold bullion coins are sold at cost with a markup for coin design and known provenance. They are valued by weight and are most often considered legal tender.

Numismatic coins—These gold coins are valued (on top of the intrinsic value of the metal) by their collectability, rarity, artistry, condition, age, and limited vintage.

There are several reasons we believe gold may be a good way to potentially help in protecting your assets. The value of gold and other precious metals has remained evident, even in times when paper currencies and other assets fluctuate with the economy and political instability.

Rosland Capital is your gold and precious metals resource. In addition to our work to educate and inform the public about the potential benefits of gold and precious metals ownership, Rosland Capital is also actively involved in philanthropic initiatives. We have supported several causes over the years, including:

Rosland offers you:

We're based in Los Angeles, California, and our business has expanded steadily since inception in 2008. Rosland is overseen by CEO Marin Aleksov, a 25-year veteran of the precious metals industry.

Rosland Capital has an exclusive selection of exciting and distinctive gold and silver coins, including many that are eligible for precious metals-backed IRAs. Rosland offers desirable bullion, numismatic and premium gold coins, including the American Gold Eagle. We also have a range of unique limited-edition specialty coins, such as our line of Formula 1 coins, PGA-licensed coins, and others. Coins are an easy and practical way to own value-retaining gold as part of your assets.

For hundreds of years, kings and emperors hoarded gold bars as hallmarks of wealth. Today, not much has changed: including gold bullion bars (gold in bulk form that is regularly traded in large formats on major markets) in your financial assets is a tried-and-true strategy for helping potentially safeguard your wealth. Rosland's convenient-to-own, certified precious metal bullion products are of the highest quality, helping to give you comfort and peace of mind regarding value. Rosland's bars and many of its coin offerings are eligible for precious metals-backed IRAs.

A gold-backed IRA, or a precious metals-backed IRA, is a self-directed IRA that holds precious metals.

Including gold and other precious metals in your collection potentially helps lower your risk by diversifying from paper assets, thus potentially hedging against the economy and inflation. Through turbulent times, such as an economic downturn or even a war, gold and other precious metals retain some value.

Rosland Capital offers gold and silver products for inclusion in gold-backed and precious metal-backed IRAs.

Be aware that the IRS regulates and controls the products that can be added to your gold IRA. That's why it's important to choose an industry authority like Rosland Capital, to help ensure you're receiving expert insight and have access to excellent IRA-eligible products.

To learn how a precious metals IRA from Rosland Capital can help you, click here to receive free information.

Ready to buy gold from Rosland Capital? Here are 5 easy steps:

Enter your information below to be contacted by a Rosland representative.